Owning a Home in India While Living Abroad: A Step-by-Step Guide for NRIs

Planning to buy property in India while living overseas? You’re not alone. Thousands of NRIs are turning to trusted partners like Real Connect to make their homeownership dreams in India a reality — smoothly and securely.

📞 Call now: +91 7483236707 | 📩 Email: contact@realconnect.co.in | 🌐 Visit: realconnect.co.in

Why NRIs Are Buying Homes in India Today

Whether it’s to reconnect with roots, build rental income, plan retirement, or secure a valuable investment — NRIs are re-entering the Indian property market in large numbers. Bengaluru, Mumbai, Pune, and Hyderabad are leading the charts, with high ROI and improved infrastructure making them long-term winners.

With evolving laws, RERA compliance, and smarter digital services, owning property in India while living abroad is now easier than ever before.

Step-by-Step Guide for NRIs to Buy Property in India

Step 1: Understand What You Can Legally Buy

As an NRI under FEMA (Foreign Exchange Management Act), you can:

- Buy residential or commercial properties (apartments, villas, plots, offices)

- You cannot buy agricultural land, plantation property, or farmhouses without RBI approval

💡 Tip: Stick to RERA-registered projects with clear documentation for peace of mind.

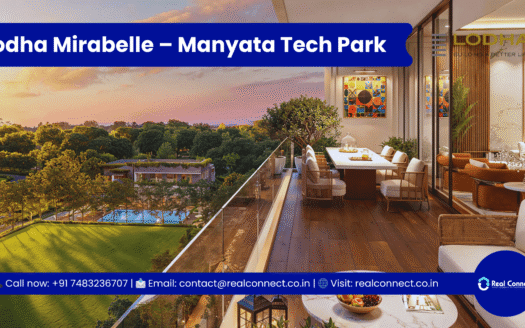

Step 2: Choose the Right Location

For NRIs, it’s crucial to select a city or micro-market that promises long-term appreciation and rental yield. In 2025, the top-performing NRI-friendly hubs include:

- Bengaluru: Panathur, Whitefield, Sarjapur Road, Hebbal

- Mumbai: Thane, Dombivli, Upper Chembur

- Hyderabad: Kokapet, Gachibowli, Kompally

- Pune: Hinjawadi, Baner, Kharadi

💡 With Real Connect, you’ll get micro-market insights and developer comparisons before making a decision.

Step 3: Appoint a Power of Attorney (POA)

If you’re not physically present in India during the buying process, appointing a Power of Attorney (POA) is essential. The POA can:

- Sign documents on your behalf

- Register the property

- Represent you in financial or legal matters

💡 We’ll help you draft and notarize a valid POA in your country of residence.

Step 4: Arrange NRI Home Loan (if needed)

Most leading Indian banks offer special NRI home loan schemes:

- Loan tenure up to 20 years

- Lower interest rates for salaried NRIs

- Loan disbursed directly to developer’s account

💡 Real Connect can connect you to the best NRI loan partners with minimal paperwork.

Step 5: Complete the Purchase and Registration

Once your documents are verified, and finances are in place, you’re ready to book:

- Sign Agreement to Sale

- Pay booking & stamp duty

- Complete Registration & Possession

💡 We’ll coordinate with developers, legal teams, and local registrars on your behalf.

Why Choose Real Connect as Your NRI Property Partner?

With Real Connect, you’re not just buying property — you’re building peace of mind.

- 🌐 Virtual Tours & Video Walkthroughs

- 📄 End-to-End Documentation Support

- 🧾 Loan & Legal Assistance

- 💬 Dedicated Relationship Managers across Time Zones

- 💰 Zero Brokerage – Transparent Deals Always

Start Your Property Journey with Real Connect Today

Whether you’re in the US, UAE, UK, Singapore, or Australia — Real Connect helps you own a home in India, hassle-free and with full support.

📞 Call us at: +91 7483236707

📩 Email: www.realconnect.co.in

🌐 Visit: www.realconnect.co.in

Owning your dream home in India is no longer a dream — it’s a guided process. Let’s begin.